After Roblox’s Q1 Results Underwhelmed, Has Anything Changed for Brands on the Platform?

Roblox’s shares fell 22% on May 9 after it reported results for the first quarter of 2024 and provided guidance for the second quarter that underwhelmed relative to Wall Street estimates. Although investors were dismayed at the company’s execution shortfall in the quarter, has much changed for brands and IP owners investing in the platform?

Our view is no, not really, and here’s why.

Why Was Wall Street Disappointed in Roblox’s Results?

To summarize a complex web of metrics in one word, it’s “credibility,” or a loss thereof. As an experienced investment analyst, one of the things I’ve heard professional investors discuss about companies over and over is the credibility of the management teams: do they have a strong track record of setting expectations and meeting or beating them?

Usually, this comes to light in the form of formal guidance for financial metrics. Roblox actually gave its first-ever set of formal guidance when it published results for 2023 in February, setting targets for metrics such as net bookings for 2024. Usually, management teams tend to provide conservative outlooks, giving them the ability to manage Wall Street expectations and possibly beat those targets.

With Roblox cutting its outlook for 2024 net bookings just one quarter in, investors were spooked by this perceived lack of visibility to future trends. Roblox’s initial 2024 net bookings guidance issued in May called for $4.21 billion but it revised that lower to $4.05 billion.

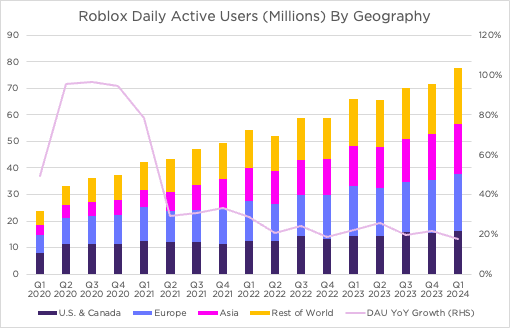

Moreover, Roblox has set longer-term “soft targets” of daily active users, hours engaged and bookings to all grow 20% or more per year. And in Q1 2024, DAU and hours engaged growth fell well short of the 20% hurdle, while bookings grew 19.4%, a tad below.

Has Much Changed for Brands on Roblox?

Not really, at least based on one quarter of results.

As Yon said in an interview with Investing.com after the results:

“We are seeing daily active users increase in the millions, people are spending more time on the platform and more than 50% of those people are over 13. Wall Street and developers have different priorities. While earnings reports are important predictions of a company’s success, as a developer, we are focused on the long-term, not the immediate numbers.”

Although brand investment on virtual platforms cooled sequentially in Q1 2024 from Q4 2024, as reported by GEEIQ, there is still sizable interest and investment from brands in virtual worlds. New brand activations fell 29% sequentially in Q1 2024 across all virtual world platforms but was still up 65% year-over-year. The fourth quarter tends to see the heaviest brand investment, with promotions centered around the holidays, so a sequential decline isn’t concerning.

What we have seen changing over the last 6-12 months though is 1) how brands are investing and 2) what a successful brand investment on Roblox looks like now vs. just a few years ago.

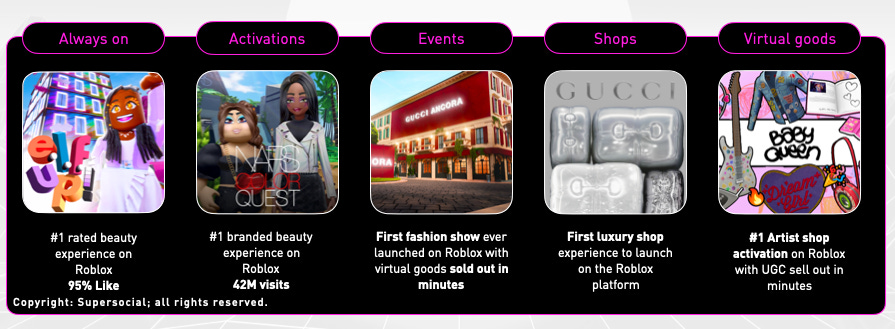

Brands today have a spectrum of options to activate on the platform, as we highlighted in a recent letter. But just to recap, these include:

Always-on, persistent worlds

Timed activations

Short-term events

Shop experiences

Virtual goods collections

Integrations

Immersive ads

With so many more options available on how to activate on Roblox, we see brands taking more time to learn what works, what success looks like and what outcomes they are optimizing for.

And this ties into the second point, that the definition of a successful Roblox activation is shifting. Although the number of brands that have activated on Roblox is still quite small relative to all of the brands in the world, those that have done so are moving from the testing and learning phase to focusing on value creation. And as such, the types of activations, the goals and measures of success are shifting.

Success of early activations was largely measured in awareness and engagement metrics, such as total visits, unique users, and playtime. But as brands move from this testing and learning phase, they are now looking at how they can make Roblox experiences more than just an awareness tool and turn it into a core business asset that can drive real-world value, through on-platform monetization, customer acquisition, and soon real-world commerce.

Create Value on Roblox with Supersocial

Supersocial has a proven track record of working with brands and IP owners across industries including luxury and fashion, beauty and cosmetics, retail, media and entertainment and consumer products to build value-accreting business assets. If you’d like to learn more how we can partner with your brand or IP to do the same, get in touch with us here.

🔥💗🌟