Roblox vs Fortnite - 1 Year Later

One-year on from the release of Unreal Engine for Fortnite (UEFN), how do Roblox and UEFN stack up?

It’s been a full year since Epic Games unveiled Unreal Engine for Fortnite and the developer ecosystem continues to grow on the platform. But how does UEFN stack up to Roblox, a platform that has been around for nearly two decades and features a much broader set of tools for developers?

In this letter, we assess the platforms across five vectors:

User Reach

Demographics

Creator Communities

Developer Economics

Brand Activations

Let’s dive in.

Roblox vs. Fortnite: User Reach

Roblox and Fortnite are two of the largest immersive platforms in the world. Although they both started as games, they have expanded to become a major social network for their users. In some cases, they even serve as the primary social platform.

Calling Roblox or Fortnite just “games” in 2024 is akin to viewing Instagram as just a platform for sharing selfies. Although the platform may have its roots in this view, they have evolved to something much larger.

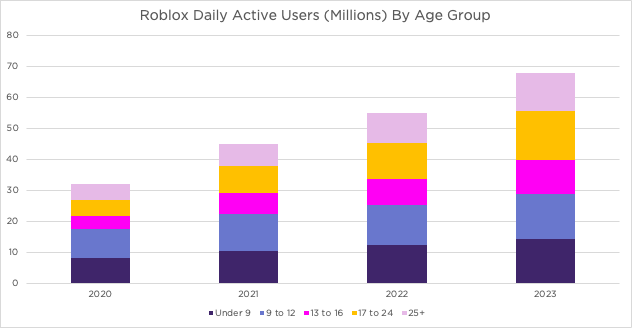

As of the fourth quarter of 2023, Roblox reached 72 million daily active users (DAUs) and likely has more than 300 million monthly active users (MAUs) on the platform. The platform’s DAU has grown at a 28% CAGR since 2020, which we view as significant given the boost to engagement that occurred during the pandemic and the fact that growth has sustained at such a high level since then.

Roblox users also continue to spend almost 2.5 hours per day on the platform, which has remained steady even as DAU has grown sharply.

For Fortnite, although the DAU is difficult to estimate, activplayer.io estimates that the Fortnite platform has roughly 225 million MAU. Fortnite has over 500 million registered players that spend 6-10 hours per week on the platform, according to Demandsage.com. This translates to about 1-1.5 hours per day.

Roblox vs. Fortnite: Demographics

The data shows that Roblox’s active user base is larger than Fortnite’s and that Roblox users are more engaged in terms of daily hours of engagement. But what do the demographics of each platform look like? Are they serving a similar audience or are they reaching distinctly different user bases?

It’s evident from the data they do in fact serve distinctly different audiences. Roblox skews to a slightly younger audience that is more evenly distributed among gender identity, while Fortnite targets a slightly older audience that skews much more heavily male.

According to Roblox, 53% of its DAU identify as male and 39% as female. This compares to Fortnite, where some estimates peg the male user base as a percent of the total north of 80%.

In terms of age ranges, Roblox’s largest age groups are 13-16 and 17-24, which made up 30% and 34% of DAU in 2023. That compares to Fortnite, who’s largest age groups are 17-24 and 25-35. Although there is clearly some overlap in the user bases, the largest cohorts of Fortnite do skew a bit older than those of Roblox.

Still, Roblox is successfully aging up the platform, both organically as players get older and attracting new, older players. From 2020 through 2023, the percentage of DAU over the age of 17 increased to 41% of DAU from 31%. And for those that think that Roblox is still just a platform for kids, it’s important to note that in 2023, the 17+ cohort of DAU was just about the same size as the DAU of those 12 and under.

Roblox vs. Fortnite: Creator Communities

The scale of the creator communities between Roblox and Fortnite are significant and reflect the relative maturity of the platforms. Roblox has been around for two decades; UEFN is a year old and Fortnite Creative doesn’t predate it by too much. Still, both platforms only have a small handful of developers earning the majority of revenue.

Roblox has over 5 million creators on the platform. In 2023, 885 developers earned more than $100,000 on the platform and 105 earned more than $1 million. Fortnite has nearly 25,000 creators now. In 2023, 368 creators earned more than $100,000 and 43 earned more than $1 million. Although the scale of the overall creator bases is vastly different, both are top heavy in terms of earnings and engagement.

Data sources: Roblox company filings, Fortnite.gg.

It’s important to note that on average, experiences created by Epic Games — including Fortnite Battle Royale, LEGO Fortnite, Zero Build - Battle Royale and Ranked Battle Royale — account for about two-thirds of concurrent users on the platform. This means that they also account for the lion’s share of engagement-based payouts.

Roblox vs. Fortnite: Developer Economics

Both Roblox and Fortnite present challenges in building a scalable games business but Roblox’s ecosystem is far more mature in terms of providing various avenues of monetization and building a games business.

It’s evident that Fortnite Creative and UEFN is still very much in its infancy and experimental stage. Revenue on the platform is 100% driven by engagement-based payouts whereas on Roblox, there are multiple means of monetization. Engagement-based payouts exist on Roblox but are a small portion of developer revenue, whereas avatar cosmetic items, in-game items and advertising all contribute to income earned on the platform. In 2023, developers on Roblox earned more than double those on Fortnite.

On Fortnite, Epic controls the avatar economy, selling skins and other items exclusively made by them on behalf of brands, IP owners and others. On Roblox, the avatar economy is fully open for creators to make virtual clothing and fashion goods — known as UGC items on the platform — while it’s also possible to create customized animations, avatar emotes and other avatar items.

As Fortnite grows, pressure may mount on Epic to open up the economy for creators to monetize beyond just engagement-based payouts, including opening up the avatar economy. This will be a big decision point for the company, as a significant share of its Fortnite revenue still hinges on avatar items such as cosmetics and emotes that it exclusively sells.

Roblox vs. Fortnite: Brand Activations

Roblox is also a much more mature platform in terms of branded experiences and brand integrations into existing worlds than Fortnite. While Fortnite has long succeeded with IP integrations via cosmetic sales in the core Fortnite Battle Royale, it’s still at a much more nascent stage of attracting brands to build bespoke islands or activate inside of existing ones.

According to GEEIQ, there were 106 new brand experiences and integrations in Q4 2023 on Roblox vs. 56 on Fortnite. Both are seeing rapid growth in brand activations, with new experiences and integrations growing 63% and 100% sequentially for Roblox and Fortnite respectively in Q4 2023.

Although Fortnite is a promising platform and eventually will help brands reach a targeted, engaged audience, it’s still early days and the challenges presented by the nascency of the platform such as the lack of UGC tools and user acquisition make it challenging for brands to do anything more than marketing activations. And even those that have tried have seen mixed results: GEEIQ noted that a Fortnite activation by Old Spice reached a peak of one concurrent user, while a similar experience from Nivea on Roblox had 363 peak concurrent users.

What’s Next?

Over the next few months and years, we expect Epic to continue rolling out new features for Fortnite Creative and UEFN to support developers and grow the ecosystem, but it’s still early days. For example, Epic announced that its MetaHuman technology is coming to UEFN so that creators can fill islands with high-fidelity NPCs. Creators will also be able to leverage LEGO branded assets in their islands, while features such as first-person systems are on the way. Questions still remain around monetization and the ability to build scalable, profitable businesses on the platform.

For brands and IP owners, Fortnite Creative and UEFN present opportunities to launch short-term marketing campaigns focused on engagement and raising awareness. But it’s very difficult to reliably build branded games and experiences that can self-sustain commercially currently. And developers have to continue grappling with the fact that you are competing with the platform for engagement and revenue.

On Roblox, although building a successful game is by no means easy, the platform has a far broader set of developer tools and monetization avenues that, at least in our view, provide a greater chance of building profitable games. Brands, IP owners and creators that continue to push the boundaries of what’s possible, engage authentically with the core user base and are willing to invest for the long-term are seeing promising trends.

So far, hundreds of brands have activated on Roblox. We expect this number to grow exponentially over the next few years, as more brands see value in reaching this unique user demographic and as brands migrate from the initial phase of testing and learning on the platform to incorporating it as part of their core business strategy and go-to-market.

Still, it’s very early days for the immersive Internet. If you’d like to learn more about activating on Roblox and the various ways that brands, IP owners and others can engage with digital natives on the platform, get in touch with us here.