Global asset markets have slowly and then all at once sunk into what is clearly a risk-off environment and will likely lead to bear markets across most risk asset classes. Metaverse pure-play companies like Roblox and Unity have seen 80% and 83% drawdowns from their highs, the Roundhill Ball Metaverse ETF is down 51% peak-to-trough while the Nasdaq Composite Index is down 30% and the Bloomberg Galaxy Crypto Index has lost 67%. So what does this all mean for the metaverse?

Let’s dive in.

A Macro View of the Markets

For those less interested in broad macro takes and more focused on the metaverse, this section might be skippable. But I think it’s worthwhile to set a framework for where markets have gone in the last six months overall as a lens for looking at metaverse asset price fluctuations and their outlooks.

If you pull up any financial media, you’ll probably run across many articles or videos discussing inflation, interest rates and volatility. While they all have different underlying causes, some of which are still hotly debated, they all have similar implications for risk assets. So we don’t need to spend time discussing why inflation is high, why interest rates are rising or why supply chains are still mucked up, we just need to acknowledge that this is the investing backdrop we have and it probably isn’t going away for some time.

What we do know is this – the Federal Reserve, and most other global central banks aside from the Bank of Japan and the People’s Bank of China, are tightening policy and raising interest rates at an accelerating pace. But as many market watchers note, it isn’t just the actual act of doing this that causes tightness in financial markets, it’s the expectation of tightening of policy that leads to a re-assessment of valuations for risk assets.

As Dan Tapiero (@DTAPCAP on Twitter) pointed out, financial conditions as measured by Piper Sandler’s Cyclical Cost-Conditions Index are significantly tighter than they’ve ever been, even though the Fed has only skimmed the surface of raising interest rates and removing QE stimulus. To put it succinctly, the Fed had to just talk seriously about tightening and the market did its job for it.

Finding the Right Valuation Framework

What’s really at stake is finding the right valuation framework for the market in which one finds oneself. During the bull market in the late 2010’s and after the covid lows in March 2020, many looked at high-growth, high-multiple tech companies – which at the end included metaverse companies – through a lens of discounted cash flows and return on invested capital over a long-term horizon, say 10 years. In a world of super-easy monetary policy and little to no volatility of risk assets, having this long-term view can work (or at least it did).

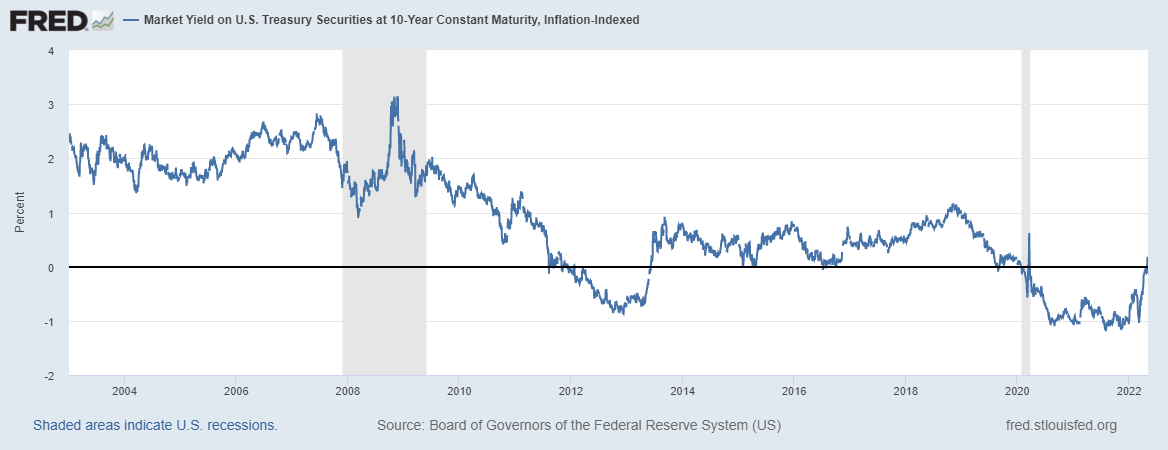

The common threads to low volatility in risk assets, whether you look at equity volatility via the VIX Index or the MOVE Index for bonds or others, was easy monetary policy and no inflation. Or in other words, we had stable real interest rates. In this environment of stable real rates, these long-term investing strategies tend to work.

But inflation has injected a burst of volatility back into markets as real interest rates have surged sharply. And in these environments, the valuation framework shifts back towards more traditional valuation metrics such as those based on earnings and cash flows as opposed to those based on revenue, growth, market sizing and long-term fundamental estimates.

The concept of duration in bonds is useful in regards to high-growth equities where so much of the value is based on outer year estimates and growing into a certain valuation. Duration, for those that don’t know, measures a bond’s price sensitivity to market interest rate changes. We know that as interest rates go up, bond prices go down, but how much do they go down? Duration is a framework for analyzing the impact.

When assessing duration, the math works out to show that bonds with longer maturities, those that pay back principal of the bond at a later date, have higher duration and therefore higher sensitivity to interest rate changes. The same can be said for high-growth stocks vs. more stable, mature companies, sometimes referred to as value stocks. High-growth stocks are much more sensitive to interest rate changes, and so we’ve seen a massive regime shift in terms of asset flows and returns from growth to value amid rising real interest rates. And so long as central banks stick to their guns over the next 12-24 months in terms of tightening policy, the backdrop for high-growth metaverse companies will remain extremely tough given that most, if not all, of them are unprofitable today and won’t likely turn a profit for a few years.

To Survive, Reduce the Burn

In the boom times, a lot of startups can get funding. Especially in recent years, with seemingly every week there being another record VC fundraising announcement, it was entirely evident that there was a surplus of capital chasing returns in the late stages of the cycle.

In the bear market, we’re already seeing venture and other early stage investors pare back their risk profiles and become more selective. As David Sacks of Craft Ventures said, “Startups with high growth & moderate burn will get funded through the downturn. Startups with moderate growth & high burn will not get funded through the downturn.”

It can be hyperbole, it can even be laughed at as a joke, but Wu Tang’s famous line that “Cash Rules Everything Around Me” is relevant still today. Companies that want to survive the downturn need to be focused on maximizing growth while reducing and minimizing cash burn. In the past, many start ups could get funded on a strategy of lighting money on fire to gain a monopoly or oligopoly in some nascent business then to pare back spending and flip the switch on cash flow at maturity, but today is not that day.

As David continues, “The funding environment polarizes in a downturn. So [companies with moderate growth and high burn] will rapidly burn money until they hit a wall and die. Therefore, startups in the 2nd category must accelerate growth and/or cut burn. Accelerating growth is very hard (or you would already be doing it) so cutting burn is usually the only option. In short: If you can't grow, then cut – and cut until you're cash flow positive if possible. There is no cavalry coming.”

This also ties back to another famous adage and it does start to explain why so many startups in the broader metaverse and web3 industries raised so much money over the last few years – raise money when you can, not when you have to. Although giving up equity early on or taking on debt at some point (usually through some sort of convert or preferred which is basically equity anyways in the end) can seem like a negative outcome, having a rainy day fund to get through the down periods of financing is never a bad thing. We’re clearly past the event horizon for this, but it does help to bring clarity as to why there seemed to be such a mad dash to raise funds the last few months.

Where We Are in the Metaverse Hype Cycle

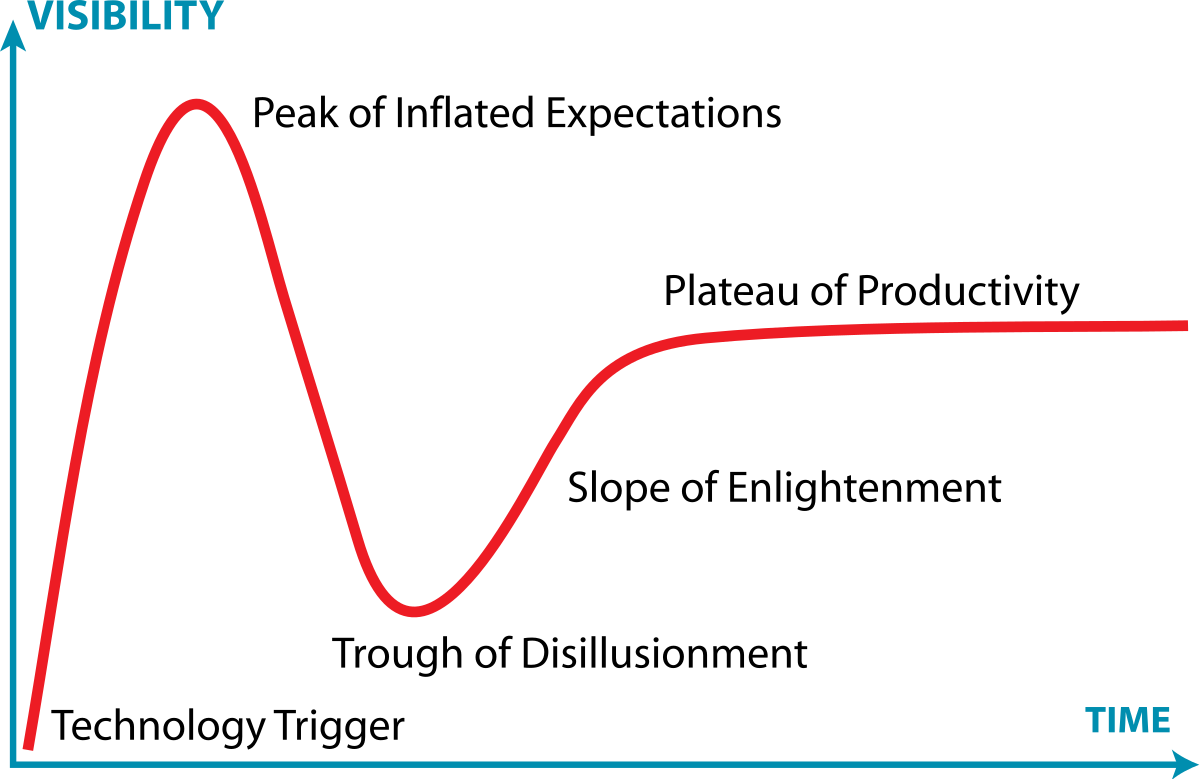

The Gartner Hype Cycle is a great way to un-scientifically understand where we are in the hype cycle of a burgeoning new technology. We clearly hit the peak of inflated expectations sometime around the fourth quarter of 2021 or the turn of the year into 2022 and we’ve clearly seen a lot of the hype come out of metaverse stock prices. But how else can we view the hype cycle coming down and what indicators can we track to see just when we hit the trough of disillusionment?

Google search trends are a powerful tool for assessing interest in a specific topic from a broad audience and it clearly points to a reduction in hype around the metaverse and web3 technologies. Popularity of the term metaverse in Google searches is just 25% of what it was in late October 2021, just after Facebook announced it was renaming itself Meta. Search interest for “Crypto” is now at 38% of the peak, “Bitcoin” 53% and “NFT” 32%.

Stock prices and VC funding starting to turn around are also solid indicators to watch for and I won’t belabor those any further since we are already 1,400 words in. Another indicator I watch closely is that of private equity activity in growth tech, mostly software but other areas like Internet also can be included. PE buyers are amazingly astute at harvesting investments to get dry powder for these sorts of scenarios – when there’s blood in the streets, they are sitting patiently for opportunities to strike.

If we start to see PE firms like Thoma Bravo or Silverlake re-accelerate their activity in these high growth sectors, that could be a sign that they think the bottom is in for valuations and that over their investment cycle, normally 5-7 years, they think that returns look attractive. As sophisticated as PE buyers are, the bulk of returns in the sector are still driven by multiple expansion for most leveraged buyouts (LBOs), meaning that they generate the bulk of returns by selling assets at higher multiples than at the valuations at which they purchased the assets. They can still make decent returns with no multiple expansion or even contraction, and many conservatively model that in assessing deal, but the outsized returns generated by the sector tend to come simply from multiple expansion.

Focusing on the Picks and Shovels for the Long-Haul

To summarize, it’s going to be tough for a lot of companies over the next 18-24 months. Those that are well capitalized already, that can and potentially already have significantly pared cash burn and those that have strong structural advantages will likely be the ones to survive. Those that can’t reduce cash burn, those that rely on continual external financing and those that are spending to simply get to a monopolistic or oligopolistic state from a hypercompetitive ground state today will probably face a much tougher road.

Valuations have come down for many assets and those that fit the criteria of being in a stronger position could be fetching attractive multiples today, especially if you have a longer-term horizon. If you’re willing to stomach volatility for the next 1-2 years, these could become the next “multi-baggers” when the next bull market run begins, likely after the U.S. economy enters a recession and the Fed flips the pedal to easing policy.

The companies that are doing the picks and shovels work of building the base technologies of the metaverse that will be relevant for decades to come and aren’t focused on the hype cycle and the next few years will likely come out of the bear market times as the biggest winners. Think along the lines of game engine companies like Epic Games and Unity or other key software vendors like Nvidia.