Roblox Earnings (Q2-2024): Takeaways

The platform continues its consistent growth and reaching an all time high 79.5 million Daily Active Users.

👋 Hey, Yon here! Welcome to Into The Metaverse. Our mission is to become the leading destintion to learn about the metaverse. Subscribe to get access to every letter and podcast show that we publish.

PS… Read our latest letter, 100 Billion Avatars, How Avatars are Transforming Online Experiences and Shaping the Future of the Metaverse.

Roblox reported earnings for Second Quarter 2024 and the results are very solid: Revenue is up 31% year-over-year, Bookings are up 22% year-over-year, record DAUs up 21% year-over-year and record Hours Engaged up 24% year-over-year.

With many people including the media this year questioning the emergence of the metaverse or the evolution of the Internet from 2D to 3D, the performance and growth of Roblox is a signal of things to come. The platform rises above the noise and continues to show consistent growth. I wanted to share a few takeaways looking at its business results and assess what they could mean for Roblox’s long term potential, looking at it from the lens of a developer on the platform.

(1) Key Results for Second Quarter 2024

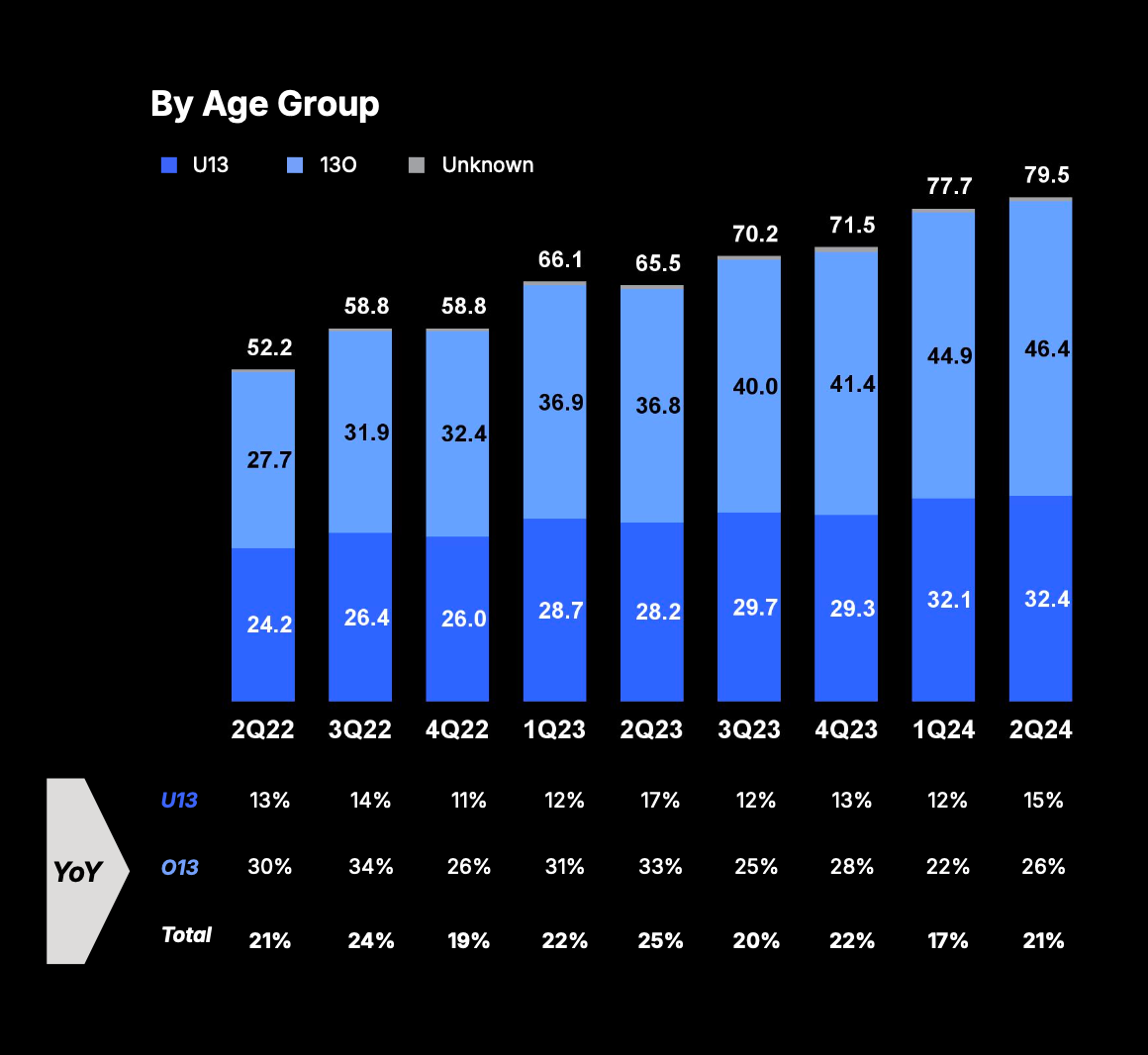

DAUs were 79.5 million, and grew by 21% over Q2 2023. Growth in Q2 was robust among all ages, but was notably strong with DAUs aged 13 years and older. Growth also remained strong among all geographies, with the US & Canada growing at its fastest rate since Q1 2021.

Revenue was $893.5 million in Q2 2024 and grew by 31% over revenue in Q2 2023. This was above Roblox’s Q2 guidance range of $855 - $880 million.

Hours of Engagement were 17.4 billion, and grew 24% over Q2 2023. Similar to DAUs, growth in Q2 was robust among all ages, but was notably strong with DAUs aged 13 years and older. Similarly, growth remained strong across all geographies.

Bookings totaled $955.2 million and grew by 22% over bookings in Q2 2023. This was above Roblox’s Q2 guidance range of $870 - $900 million.

Average monthly unique payers were 16.5 million, up 22% year-over-year, and average bookings per monthly unique payer was $19.34.

Average bookings per DAU was $12.01, up 1% year-over-year.

“Our strong Q2 growth across all core metrics is driven by diverse and high quality content. As a UGC platform, we support a large and motivated creator community that continues to thrive. The dynamic Roblox content ecosystem is unique and our platform continues to attract users of all ages from across the globe. Going forward, we will continue to invest in our core platform to help our creator community build better and safer experiences and reach more people,”

-David Baszucki, founder and CEO of Roblox.”

(2) Takeaways

In Assessing Roblox in the Long Term I stated that when I’m evaluating the long-term prospects of the platform with my hat on as the CEO of Supersocial, I’m looking at five key pillars:

Developer Ecosystem

Content & Experiences

Aged-Up Users

Daily Active Users

Geographic Breakdown

Let’s assess Roblox’s results through lens of these five pillars.

1) Developer Ecosystem

Over the past 10 years Roblox has nurtured a community of millions of developers and creators who built millions of games and experiences now used by millions of users globally. Ensuring that developers on the platform, small and large, can monetize and build a business that stands on its own is, and should be, a key priority for Roblox the company. In Second Quarter of 2024 developers earned $208.3 million, an increase of 26% from the $165.8 million earned in Second Quarter of 2023.

Generating revenue is not the only thing that keeps developers loyal to the platform - they also make friends and many of them grew up as players on Roblox and gradually becoming builders. I continue to consistently argue that the passion and dedication of developers to the Roblox platform is one of the platform’s most important competitive advantages and is second to none on consumer internet platforms.

2) Content & Experiences

The diversity of content on the platform means that any of Roblox’s millions of daily users can find something that they are excited to play and invite their friends to play with them. The low friction of accessing content through one master app and the enormous library of content that’s available to users at any given moment continues to be a key pillar of Roblox’s flywheel.

The hours engaged KPI is a key parameter which shows the outcome of Roblox’s content flywheel but it’s the fact that Roblox has millions of loyal developers and creators in the first place that are creating the massive content library which is at the core of that flywheel. As long as Roblox continues to have a committed community of developers and creators, we will continue to see more and more content created and more and more hours of engagement.

Hours Engaged in the Second Quarter of 2024 was 17.4 billion, up from 14 billion in Second Quarter of 2023 (24% YoY).

Roblox also continues to show that new content can emerge and become a top 25 experience on the platform quite rapidly. Dress To Impress, which was launched late in 2023, has doubled its DAU from first quarter of 2024 to second quarter. The game has generated nearly 1.6 billion lifetime visits and at the time of writing this letter has nearly 156,000 CCU. Our eatimtes show that the average revenue of the game in the past three months (May-July) is $1.6 million.

A Dusty Trip, which was launched several months ago, is another 2024 smashing hit, generating nearly 900 million in lifetime visits and 27,000 CCU at the time of this writing. These type of stories show that fresh content contnues to be created and published and helps ensure that users always have something new to play with their friends. Our eatimtes show that the average revenue of the game in the past three months (May-July) is $667,808.

3) Aged-Up Users

One of the key strategic pillars for Roblox’s growth, in driving the growth of both the number of daily users and bookings per user is the platform’s ability to retain users as they age up and acquire new age-up users (the reference is to users over age 13). In its recent reporting Roblox stated that the user group above 13 year-olds now stands at 58% of total users on the platform, an all-time high. Roblox also stated recently that 41% of DAU are above age 17.

The next two years will be pivotal for Roblox in proving that it can continue to not only dominate the under 13 age group (which is its core audience historically) but also, and perhaps more importantly, retain them as they age up and acquire new users in the over 13 age group who may not think of Roblox as they social platform of choice.

Alongside that, Roblox will need to show that as the platform ages up, developers create content that meets the expectations and desires of the aged up users and on the back of hours engaged is able to monetize that audience more effectively, both in North America and world wide. Driving growth of in bookings per daily active users (ABPDAU) will be key to ensuring that the more professional developers are not only passionate about the platform but can also build a sustainable business around their passion. The relatively new category of games only available to 17+ users who verified their identity with ID, will be interesting to track and observe how scaled of an opportunity it is to developers and brands.

4) Daily Active Users

Everything that is happening on the Roblox platform ultimately needs to drive the growth of daily users (and bookings per user), and on that metric, Roblox continues to show consistent growth despite concerns of kids going back to school and the aftermath of the covid-related rush into screens and social platforms. Roblox is clearly not going anywhere and not only that school time doesn’t seem to interrupt usage, Second Quarter 2024 numbers show an all-time high DAU of 79.5 million (21% year-over-year growth).

When it comes to paying users, monthly unique payers (MUPs) in Second Quarter 2024 reached an all-time high of 16.5 million, up from 13.5 million in Second Quarter of 2023. Average bookings per monthly unique payer (ABPMUP) was $19.34, up from $19.32 in Second Quarter of 2023.

5) Geographic Breakdown

In Second Quarter of 2024:

21.6% os users came from the US and Canada

26% came from Europe

25.4% came from APAC

27% came from ROW

Roblox continued to execute on their international expansion strategy. In Japan, DAUs increased 56% YoY and in India 57% YoY. Roblox believes the Japanese and Indian markets continue to be strategic geographies for expansion, especially Japan which is one of the largest gaming markets worldwide. They will play a key role in helping Roblox achieve its ambition of reaching 1 billion global DAUs.

I expect this trend to continue although it’s important that Roblox (1) maintains strong monetization of North American users (who account for 61.5% of bookings) while (2) increasing bookings per user from international markets, which is not a simple thing considering that of the top 10 most engaged countries on Roblox, 5 of them are developing economies (Brazil, Philippines, Mexico, Russia, Thailand).

Bookings Per Region in the Second Quarter of 2024 ($955.2 million in total):

US & Canada: 61.5%

Europe: 19.3%

APAC: 10.5%

ROW: 8.7%

The future of the Roblox platform is not without challenges but the consistent growth it’s showing across some of the most important indicators show that Roblox’s brightest days as a platform are still be ahead. With the integration of more advanced technologies which in turn will enable developers to create ever more engaging games, experiences and virtual worlds can ensure that Roblox remains the most important destination on the Internet for kids and youth and potentially for many more young adults around the world.

As a builder on the platform, I’m going to continue and keep a close look at the growth of Roblox’s developer ecosystem (numbers and developer payouts), the growth and stickiness of its user base (both under 13 and over 13), its global footprint and how effectively Roblox monetizes outside North America, the quality of content launched on the platform, and releasing new features and technologies for creators.

The Road Ahead

When Roblox listed the company on the public markets, they outlined four growth vectors: 1) Growing in international markets; 2) Building a platform for all ages; 3) Expanding the platformʼs use cases; and 4) Growing a vibrant economy. Roblox’s results for the Second Quarter of 2024 demonstrates the progress the company has made in each of these areas.

While facing some headwinds, the gaming industry continues to represent a large market with enormous growth potential for Roblox to expand its market share and enable the platform to grow DAUs, Hours of Engagement and Bookings at high rates for the coming years.

Roblox believes that its approach to user-generated content combined with several key differentiators, such as: 1) personalized expressive avatars; 2) vibrant social graph; and 3) immersive 3D communication will provide a unique value proposition to make traditional gaming experiences more social and support new experiences unique to its platform.

Within the traditional gaming ecosystem, Roblox believes that is also have a tremendous opportunity to expand content into new genres. Today, genres such as roleplay, battlegrounds, platformers and horror are popular on its platform. Roblox understands that it must encourage developers to create even more diverse experiences in untapped areas such open world action, sports, racing and social co-opetition (see Roblox’s recent insights blog post). Roblox is starting to see early signals of user interest within these genres and by incentivizing creation, Roblox can potentially tap into new demographics which will further grow its market share within the gaming landscape. This is not a simple goal to achieve given how entranched platforms like Steam are mobile (iOS and Android) are within the gaming community but certainly should be a strategic objective for Roblox.

Last but not least, Roblox is investing in expanding its economy to include advertising and commerce. During the second Quarter of 2024, Roblox continued to make progress on those fronts with brands: 1) They launched a video ads product and continued to make progress with its self-serve Ads Manager product and third-party integrations with IAS and PubMatic; 2) Initiated its first experiments on real-world commerce with the launch of commerce integrations inside Walmart Discovered and e.l.f. UP! of which Supersocial is the developer). These are very early days especially on the commerce side but certainly a space to watch.

Yon is the creator of Into The Metaverse. He’s the founder and CEO of Supersocial, a pioneering developer and publisher focused on virtual worlds. Thank you for subscribing to Into The Metaverse. We grow when readers who appreciate our work spread the word.